You have a great idea? Congratulations!

You want to create a business out of this idea? Of course!

Well, to turn this great idea into something concrete and tangible, you need… money!

Where will you find it? At the bank?

Forget about this, unless you provide enough “collaterals” to secure a loan, which means that you fully cover the bank for the risk associated with your start-up. In such case, there is no point to go to the bank!

When you are just starting out, you are not at the stage where a lender or investor would be an option. So that leaves you with yourself, your savings account, maybe some family members and perhaps a few friends. You will realize quickly that you have less good friends that you tought! This is "Friends & Family" (some add “Fools”) financing or more nicely said, “Love Money”.

So, let’s say you get the money to start your business. At this stage, you have a great idea, some money, usually not much.

Given that this an extremely risky period in the life-cycle of a business, you need to protect yourself and will want to dissociate your own patrimony from that of the start-up business. So, you will create a company or to be more specific, a “limited” company, which will take a form and shape suitable to your needs and in accordance with the rules and laws of the jurisdiction where you create it.

Great Idea

Corporate Structure

Love Money

And then? Well, you need more money!

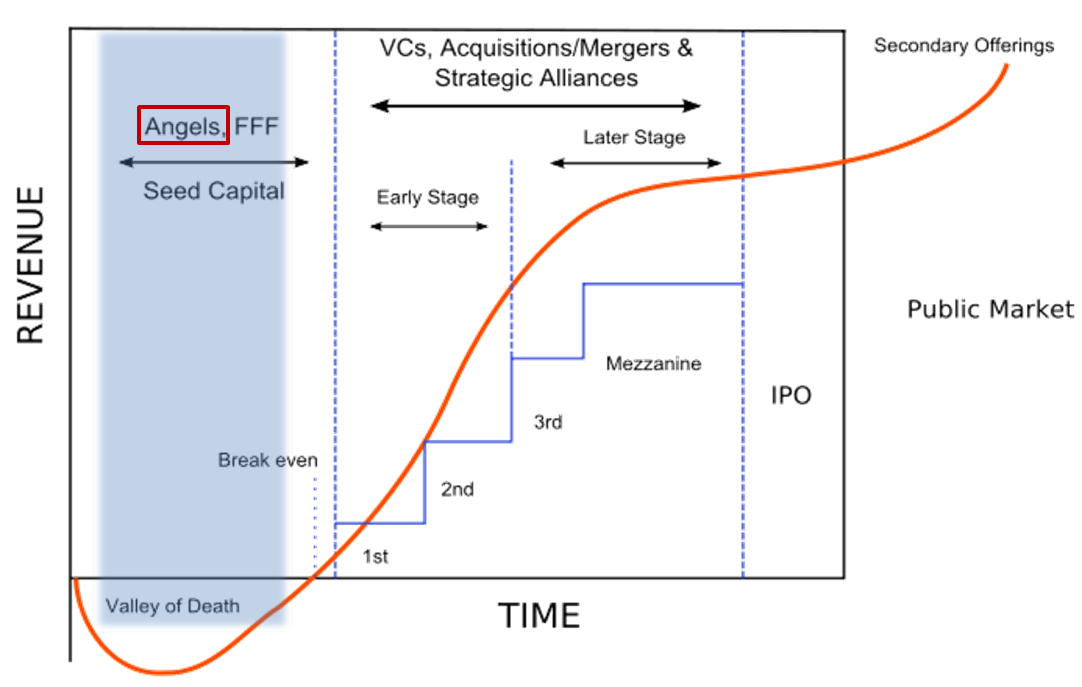

"Seed capital" is a form of early financing coming from “outside investors” who will invest capital in exchange for an equity stake in your company.

Seed capital typically comes from Business Angels, Crowdfunding, and sometimes from VC funds, although more rarely at this stage.

In many countries, government funding may be also available in the form of loans, subsidies or equity.

These potential funders have one common requirement before they may decide to provide financing, they must be convinced. Convinced of what?

Convinced that:

- Your idea is worth what you claim it to be.

- Your plans to turn this idea into a successful business is achievable.

- You and your team have the right competencies and attitude to make it happen.

Startup Financing Cycle

We, at PharmExpand, are not an investment bank.

Nevertheless, we can help you prepare for a successful Seed Capital fundraising by:

- Coaching you, so that you can better understand the fundraising process and navigate through it.

- Helping you prepare number of documents you will need to convince your future financial partners and shareholders, for instance, your Business Plan, your Pitch Deck(s).

- Altough we may help you connect you with some Business Angels, Private and Public Funds, we will never act directly or indirectly as Financial Advisor as defined by the French "Autorité des Marchés Financiers" or AMF.

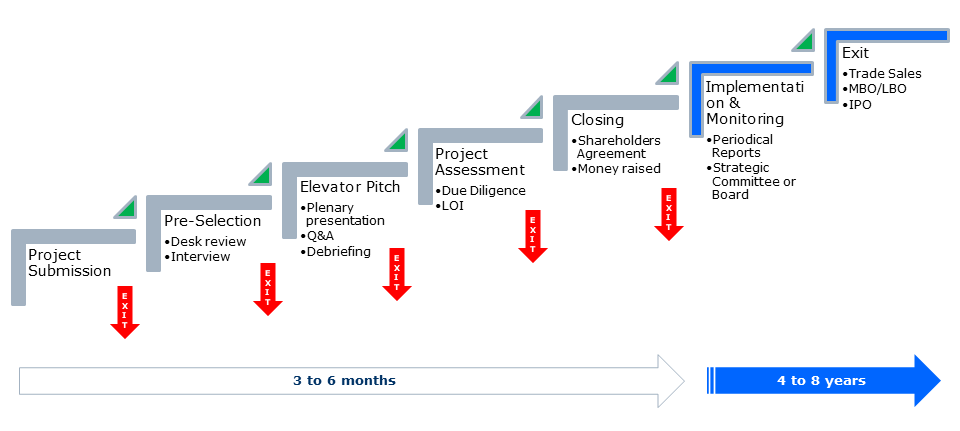

Financing process with Business Angels & Funds (illustrative)